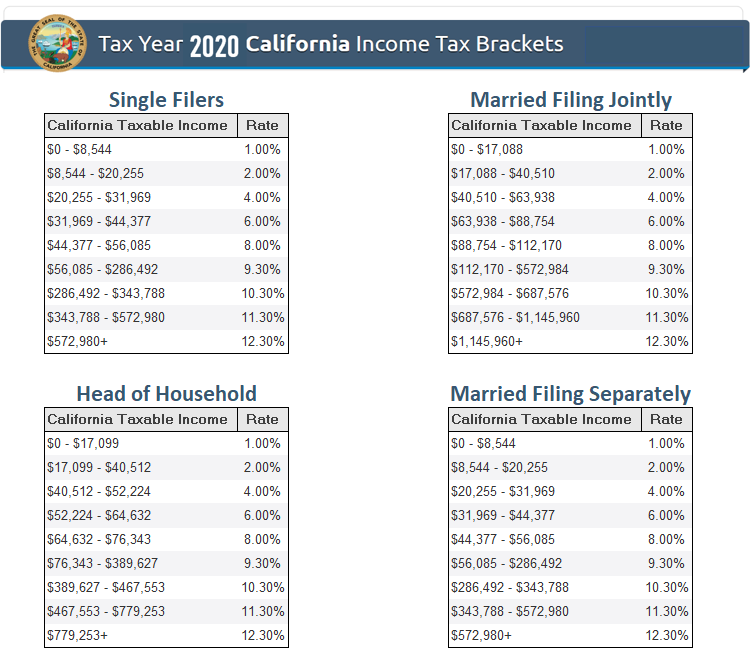

At the other end of the spectrum, Hawaii has 12 brackets. Kansas, for example, is one of several states imposing a three-bracket income tax system. Conversely, 32 states and the District of Columbia levy graduated-rate income taxes, with the number of brackets varying widely by state.

Of those states taxing wages, nine have single-rate tax structures, with one rate applying to all taxable income. Eight states levy no individual income tax at all. Forty-one tax wage and salary income, while one state-New Hampshire-exclusively taxes dividend and interest income. Their prominence in public policy considerations is further enhanced in that individuals are actively responsible for filing their income taxes, in contrast to the indirect payment of sales and excise taxes.įorty-two states levy individual income taxes. Individual income taxes are a major source of state government revenue, accounting for 38 percent of state tax collections. Some states tie their standard deductions and personal exemptions to the federal tax code, while others set their own or offer none at all. Some states double their single-bracket widths for married filers to avoid a “ marriage penalty.” Some states index tax brackets, exemptions, and deductions for inflation many others do not.

Of those states taxing wages, nine have single-rate tax structures, with one rate applying to all taxable income.Forty-two states levy individual income taxes.Individual income taxes are a major source of state government revenue, accounting for 38 percent of state tax collections in fiscal year 2018, the latest year of data available.

0 kommentar(er)

0 kommentar(er)